Vietnam’s market has emerged as a hotspot for foreign investors, driven by a rapidly growing economy and a young, tech-savvy population. With a GDP growth rate averaging 6.5% over the past decade, Vietnam is one of Southeast Asia’s most dynamic markets. The country’s middle class is expected to reach 56 million by 2030, fueling demand across various sectors.

However, market entry Vietnam requires careful planning and a deep understanding of local dynamics.

In this guide, we will explore the essential strategies for a successful market entry into Vietnam, providing you with data-driven insights and practical advice to navigate the complexities of this vibrant market.

Understanding the Vietnamese Market

Economic Environment

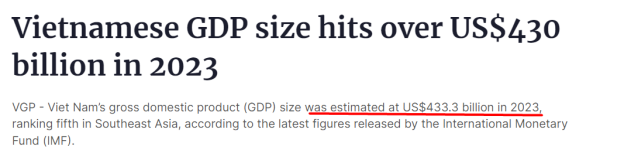

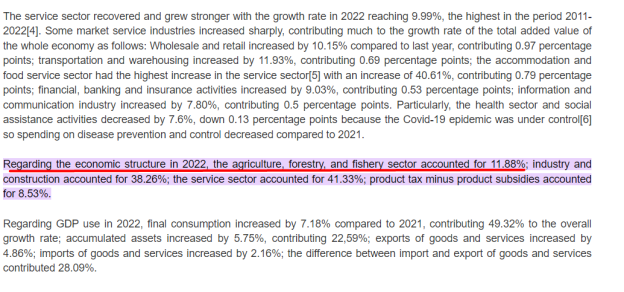

Vietnam’s economy has demonstrated remarkable resilience and growth, positioning itself as one of Asia’s fastest-growing economies. Over the past decade, the country has maintained a robust GDP growth rate of approximately 6.5% per year, even amidst global economic uncertainties. In 2023, Vietnam’s GDP reached $430 billion, a significant leap from previous years. This growth is underpinned by strong industrial output, rising exports, and increasing domestic consumption.

The potential of the market size in Vietnam

Key Industries Driving the Economy:

Consumer Behavior and Trends

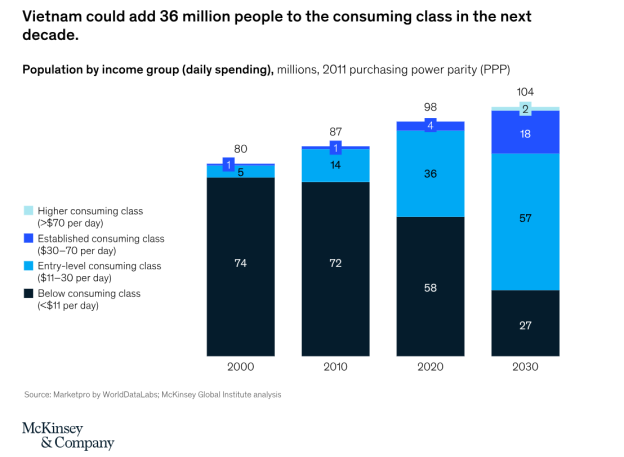

Vietnamese consumers are becoming increasingly sophisticated, with rising disposable incomes and a growing middle class. By 2030, according to Mc Kinsey, Vietnam’s middle class is expected to account for over 40% of the population, translating into higher demand for quality products and services.

The rising middle class in Vietnam

Insights into Consumer Preferences:

Internet penetration in Vietnam

Regulatory Environment

Navigating Vietnam’s regulatory landscape is crucial for successful market entry Vietnam. The country offers a generally welcoming environment for foreign investment, but businesses must adhere to specific regulations.

Overview of the Legal Framework:

Foreign Investment Law: Vietnam’s Law on Investment regulates the conditions under which foreign entities can operate. While 100% foreign ownership is allowed in most sectors, certain areas remain restricted. Restricted areas for foreign ownership in Vietnam include sectors critical to national security, public interest, and cultural preservation. Some examples include Security and Investigation Services, Temporary Import for Re-Export Business, Journalism and News Gathering. Other industries such as advertisement, tourism, transportation often require joint ventures with local partners or have specific foreign ownership caps.

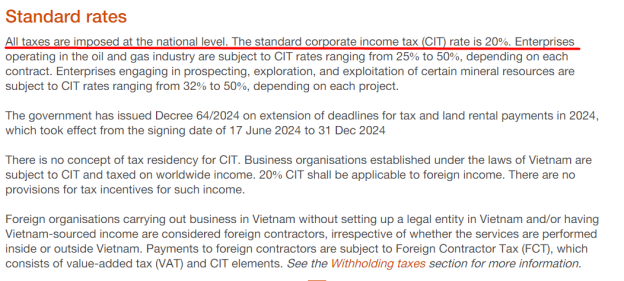

Taxation: According to Pwc, The corporate income tax (CIT) rate is 20%, but various incentives exist for businesses in high-tech, agriculture, and environmental protection sectors. For example, new projects in high-tech zones can benefit from CIT exemptions for the first four years and a 50% reduction for the subsequent nine years.

Corporate tax in Vietnam

Market Entry Vietnam Strategies

Direct Investment

Foreign Direct Investment (FDI) has been a cornerstone of Vietnam’s economic development. As of 2023, Vietnam attracted over $36.6 billion in FDI, with major investments flowing into manufacturing, real estate, and technology sectors.

Vietnam is a booming economy currently

Key investors include multinational corporations from Japan, South Korea, and Singapore, with South Korea leading the total FDI inflow. The government has implemented various incentives, such as tax breaks and simplified administrative processes, to attract foreign investors, particularly in high-tech and special economic zones (SEZs).

Pros and Cons of Establishing a Local Presence Through Direct Investment:

- Establishing a local entity provides full control over operations, allowing companies to implement global standards and practices.

- A local presence enables quicker adaptation to market changes, consumer preferences, and regulatory requirements.

- Direct investment helps build a strong local brand identity, fostering trust and loyalty among Vietnamese consumers.

- Navigating Vietnam’s regulatory environment can be complex and time-consuming, requiring thorough understanding and compliance.

- Operating directly in Vietnam requires a deep understanding of local culture and language, which may necessitate hiring local expertise or extensive training for foreign staff.

Joint Ventures and Partnerships

Partnering with a local business provides immediate access to established distribution networks, customer bases, and market knowledge. Moreover, a local partner can help navigate regulatory hurdles, reducing the risk of non-compliance and operational challenges.

Joint ventures also allow for shared financial and operational responsibilities, reducing the burden on each party and enhancing overall resource allocation.

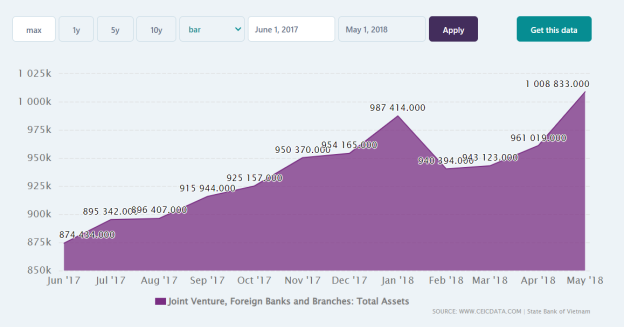

Vietnam’s Vietnam Joint Venture, Foreign Banks and Branches: Total Assets from Jul 2012 to May 2018

Key Considerations When Forming Joint Ventures:

Franchising and Licensing

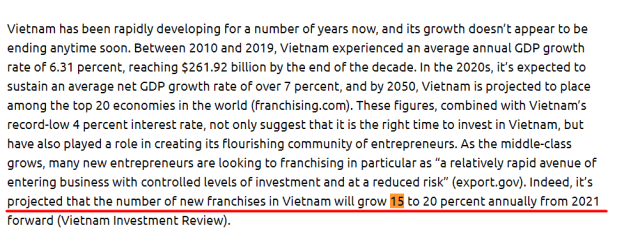

Overview of the Franchising Model in Vietnam: Franchising has become an increasingly popular market entry Vietnamn strategies, particularly in the F&B and retail sectors. The franchise market in Vietnam is projected to grow by 15-20% annually, with international brands such as McDonald’s, Starbucks, and Domino’s Pizza successfully establishing a strong presence. The legal framework for franchising in Vietnam is well-defined, with regulations requiring franchisors to register their franchise agreements with the Ministry of Industry and Trade (MOIT).

The market potential of Vietnam franchising market

See more: Foreign Owned Business in Vietnam?

Case Studies of Successful Franchises:

KFC Vietnam

Entering the market in 1997, KFC adapted its menu to include rice dishes and local flavors, leading to widespread acceptance. KFC now operates over 140 outlets nationwide, demonstrating the importance of localization in franchise success.

Lotteria

A South Korean brand, Lotteria has become one of Vietnam’s most popular fast-food chains, with over 200 outlets. Their aggressive expansion strategy through company-owned stores and franchised outlets has proven highly effective.

Exporting and Importing

Strategies for Exporting Goods to Vietnam:

Navigating Import Regulations and Tariffs:

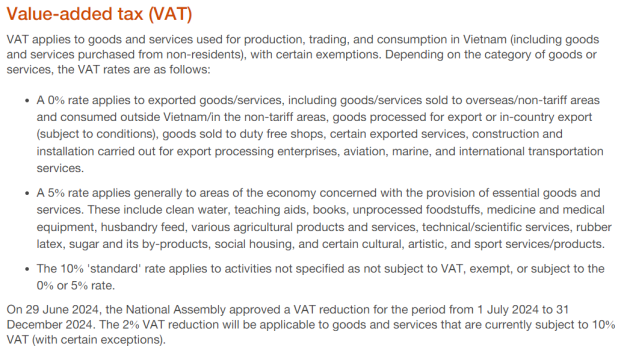

Let’s see the value-added provided by PwC below for further information:

value-added tax (VAT)

Business Norms and Etiquette in Vietnam

Understanding the business norms and etiquette in Vietnam is crucial for building strong relationships and ensuring successful collaborations. Vietnam’s business culture is deeply influenced by its historical, social, and cultural values, and respecting these norms can significantly impact your business success.

For beginners, entering the Vietnamese market can be challenging if they don’t have a companion. The Bizlen expert team deeply empathizes with this situation and guides you through every step, from strategic planning and regulatory compliance to local partnerships and cultural integration.

With Bizlen, you can confidently navigate Vietnam’s dynamic economy and establish a successful presence, ensuring your business thrives in this rapidly growing market. Let us help you make your mark in Vietnam!

Building Relationships and Trust

Importance of Personal Relationships

In Vietnam, business is often conducted based on personal relationships, known as “Guanxi” in Chinese or “Quan hệ” in Vietnamese. Establishing trust and rapport is essential before any formal business dealings can occur. This process can take time, as Vietnamese counterparts may want to get to know you personally before committing to a business relationship.

Attending social events, sharing meals, and participating in informal gatherings are common ways to build relationships. Showing genuine interest in your Vietnamese counterparts’ culture and personal life can strengthen bonds.

Trust and Loyalty:

Vietnamese businesses value long-term relationships over quick deals. Demonstrating commitment to a long-term partnership, rather than just short-term gains, is appreciated and builds trust.

Once trust is established, Vietnamese partners are often very loyal. They expect the same loyalty in return, so consistency and reliability in business dealings are highly valued.

Communication Styles

Indirect Communication:

Vietnam is a high-context culture, meaning that communication is often indirect, and much is left unsaid. Non-verbal cues, body language, and tone of voice play a significant role in conveying messages. It’s essential to pay attention to these subtleties to understand the full context of what is being communicated.

The concept of “face” (danh dự) is crucial in Vietnamese culture. Avoiding confrontation, criticism, or causing embarrassment in public is essential to maintain respect and harmony. If feedback or criticism is necessary, it should be given privately and with tact.

Politeness and Formality:

Correct titles are important in Vietnamese business culture. Address people by their title (e.g., Mr./Mrs. followed by their first name) or by their job title. This shows respect and acknowledgment of their position.

Vietnamese businesses often have a hierarchical structure, and decisions are typically made by senior executives. It’s important to direct your communication to the appropriate level of authority and show respect for their position.

Meetings and Negotiations

Punctuality:

Being on time for meetings is crucial as it demonstrates respect for the other party’s time. However, expect that meetings may start slightly late due to traffic or other delays, which are common in Vietnam.

Always schedule meetings in advance and confirm them closer to the date. Vietnamese professionals appreciate well-organized and planned meetings.

Meeting Etiquette:

Begin meetings with a polite introduction and handshake. Business cards should be exchanged using both hands, and it’s important to take a moment to read the card before placing it in a cardholder. This gesture shows respect for the person and their position.

While formal meeting agendas are appreciated, expect that discussions may not always follow a strict order. Flexibility is key, as Vietnamese counterparts may bring up topics as they feel comfortable.

Negotiation Tactics:

Negotiations in Vietnam are often conducted with a win-win mindset. The goal is to reach a mutually beneficial agreement, so it’s important to be patient, flexible, and open to compromise.

Decision-making can take time, as Vietnamese businesses often consult multiple stakeholders before finalizing a deal. Avoid pressuring for quick decisions, as this can be perceived as disrespectful.

Vietnamese counterparts value formal agreements and often expect detailed contracts. Ensure that all terms are clearly defined and agreed upon in writing.

Business Attire

Dress Code:

Business attire in Vietnam is typically formal, with men wearing suits and ties and women wearing conservative business suits or dresses. Dressing well is a sign of respect and professionalism.

Given Vietnam’s tropical climate, lightweight fabrics are recommended. However, always maintain a professional appearance, even in the heat.

Gifts and Hospitality:

Gift-giving is common in Vietnamese business culture, especially during significant meetings or holidays like Tet (Lunar New Year). Gifts should be modest and thoughtful, and they should be presented with both hands. Avoid giving overly expensive gifts, as this may create an obligation.

Business meals are an important part of relationship building. When dining, wait for the host to invite you to begin eating. It’s also customary to leave a small amount of food on your plate to show that you are satisfied.

Respect for Local Customs

Vietnamese people are proud of their history and culture. Showing respect for local traditions, history, and national symbols is important in maintaining positive relations.

Avoid discussing sensitive topics such as politics or the Vietnam War, as these can be contentious. Focus on neutral topics like culture, food, and positive aspects of Vietnam.